The 2019 Restoration Benchmarking Survey Report

The data and statistics are in and tabulated, ready for your analysis. Each July, Cleanfax compiles its annual Restoration Benchmarking Survey Report. It’s a service provided to the disaster restoration industry and provides information successful company owners and entrepreneurs need to analyze their own business practices and make critical business decisions.

If you like numbers, data, and statistics, and how they can help you grow your company, you will enjoy the information here.

About this report: The data in this survey is based on results from restoration contractors responding to invitations to participate in the survey.

View the report by scrolling, or go to the bottom of this page to download the complete results from the 2019 Restoration Benchmarking Survey Report.

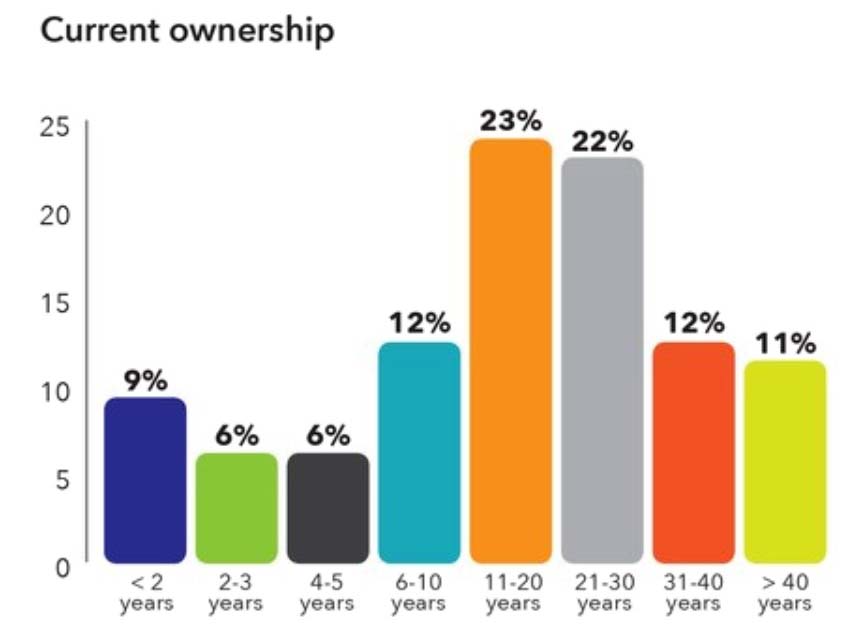

The industry is comprised primarily of long-tenured leadership with 68% of companies retaining the same ownership for more than a decade.

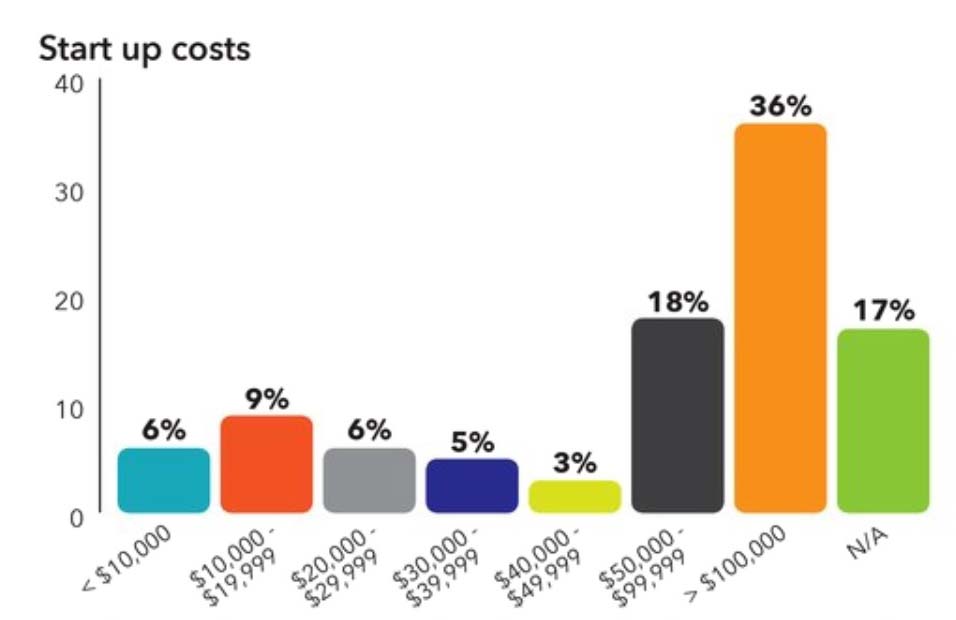

More than 71% of companies reported spending more than $50,000 to get started.

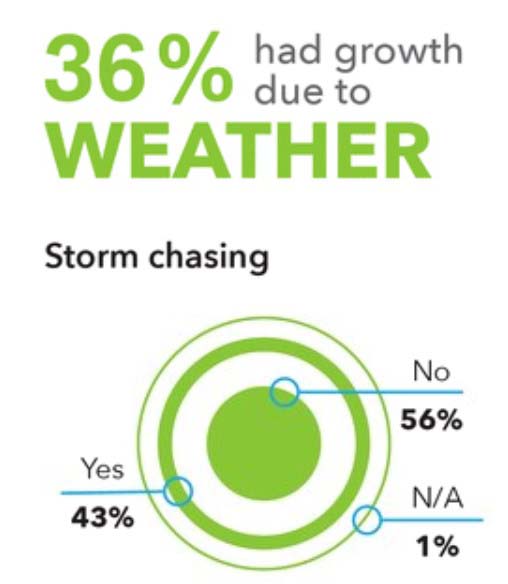

The number of companies traveling outside their local area for large-scale disasters grew 4% over 2018.

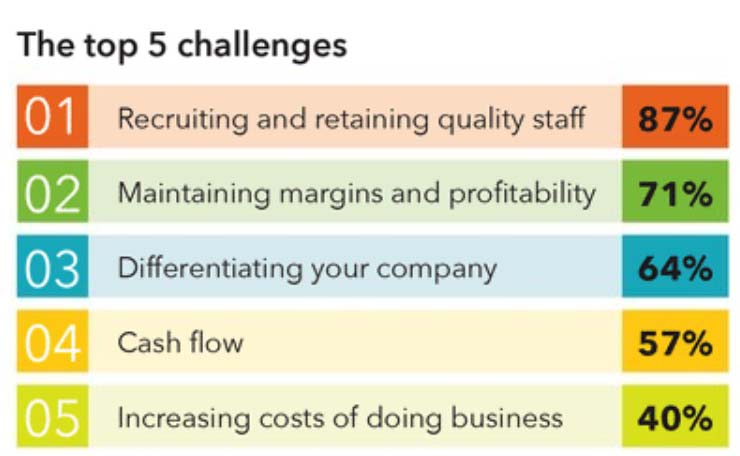

The #1 challenge dictates the #2 challenge. It takes a quality staff, one that sticks around, to maintain margins and create a profitable company.

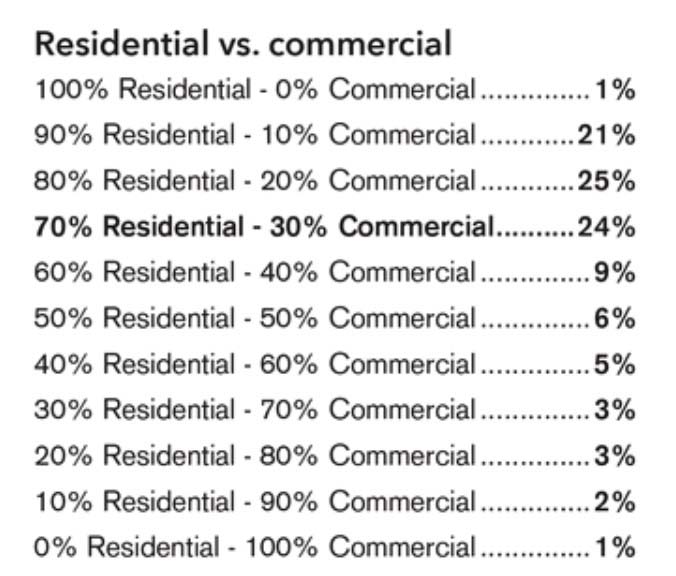

Residential jobs still make up the bulk of industry work, with 71% reporting at least 70% of business is residential.

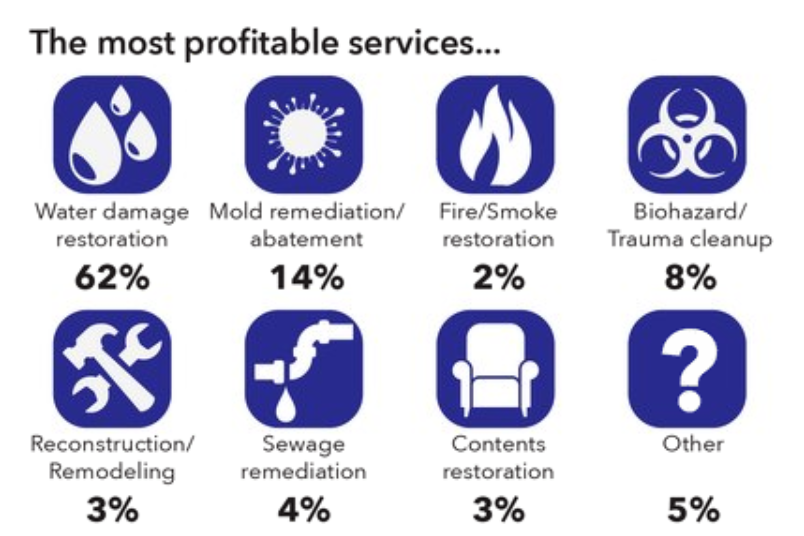

Once again water damage dominates the list of the most profitable services, with 62% reporting higher margins with mitigation than any other service.

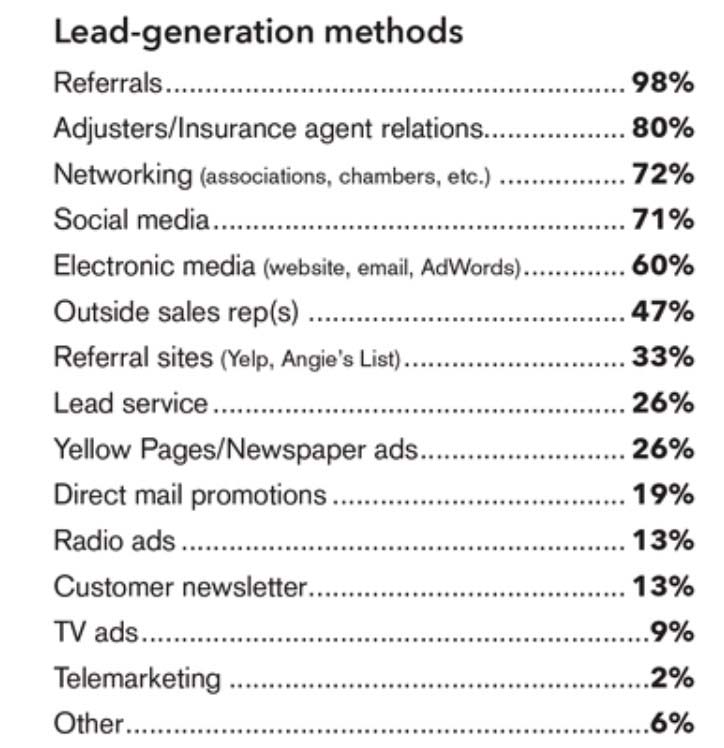

Use of adjusters made a big jump forward this year with 80% using them to get leads, compared to 62% in 2018.

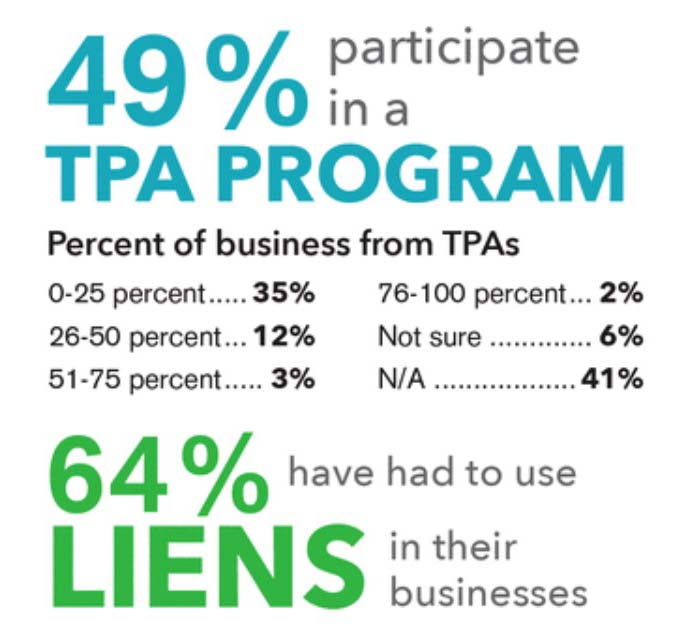

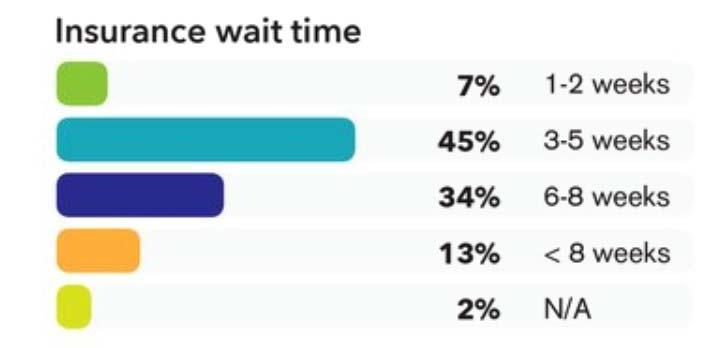

Getting paid by insurance companies is always a pain, with 47% waiting more than six weeks to receive payment.

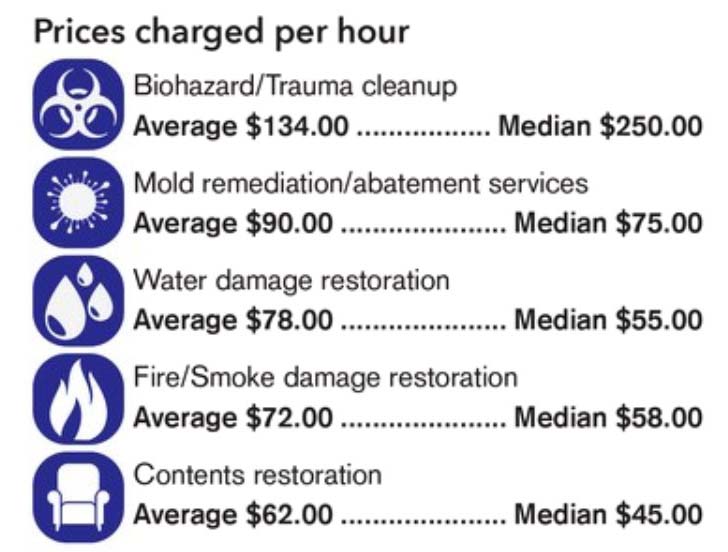

The average cost per man hour for every service went down this year (compared to 2018), as did the median for most.

A Cleanfax poll indicates most restorers have roots in the carpet cleaning industry, which is why carpet/rug cleaning is the number 1 additional service offered by most.

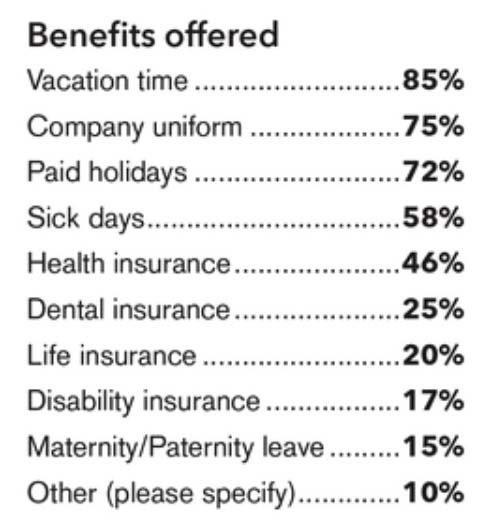

Keeping employees can be hard, but more than half of companies report average employee tenures of five years or more.

Click the preview below to view or download the complete results from the 2019 Restoration Benchmarking Survey Report.

To compare this year’s results with the 2018 Restoration Benchmarking Survey Report, click here.