2021 Restoration Benchmarking Survey Report

Welcome to our annual report on the restoration industry, the Cleanfax Restoration Benchmarking Survey Report! Each year we connect with leaders in the industry to develop a statistical view of its state to offer our readers a glimpse into current trends for developing and adjusting within their own companies.

More than 500 of you took part in this year’s survey, despite your always-busy schedules. We sincerely thank you for that!

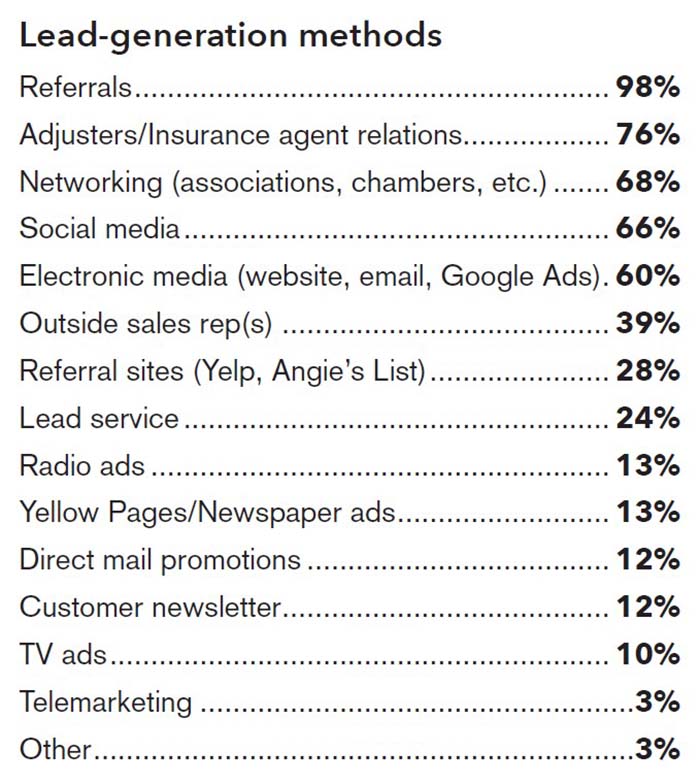

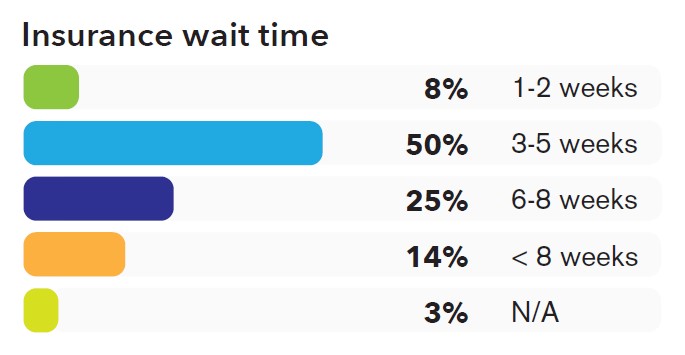

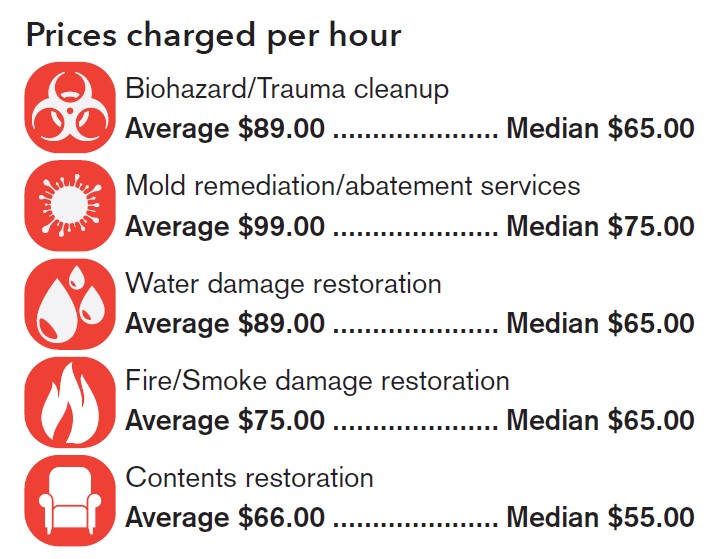

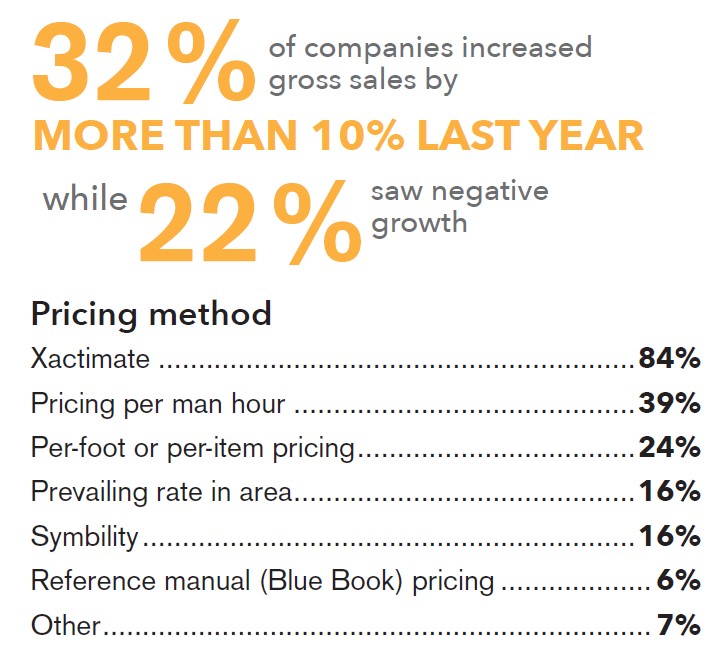

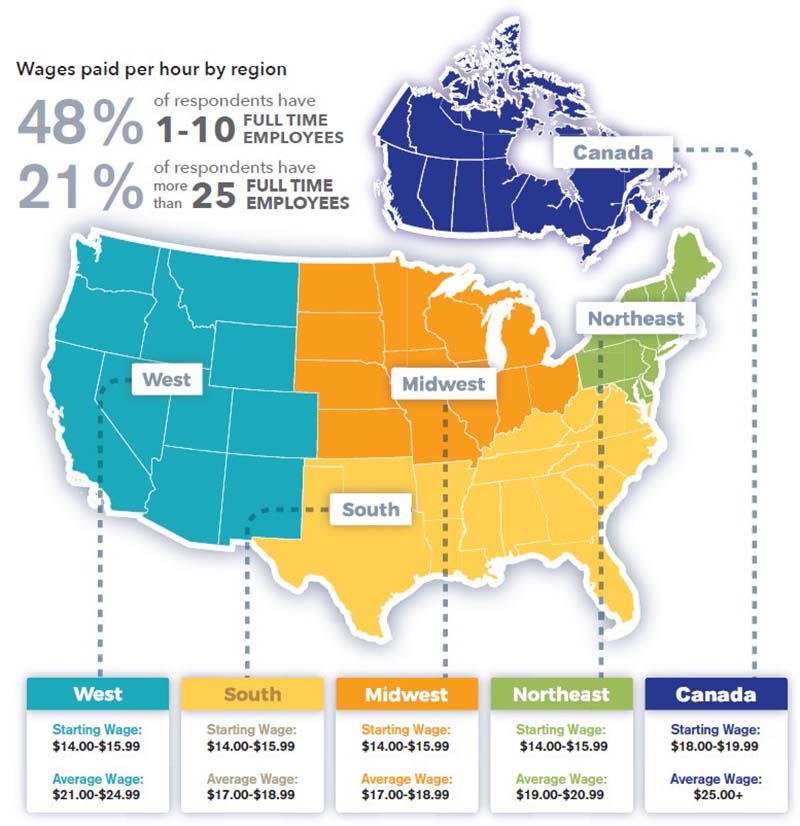

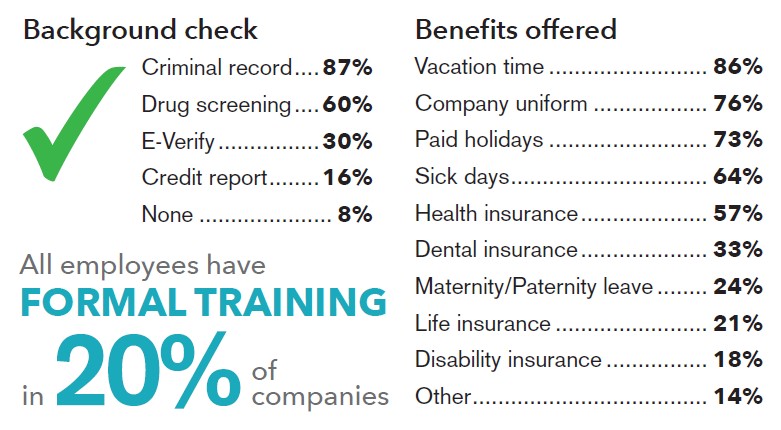

The survey’s results are highlighted over the next four pages and provide a look at how pricing is changing, what average pay looks like, how companies are bringing in new customers, and a whole lot more.

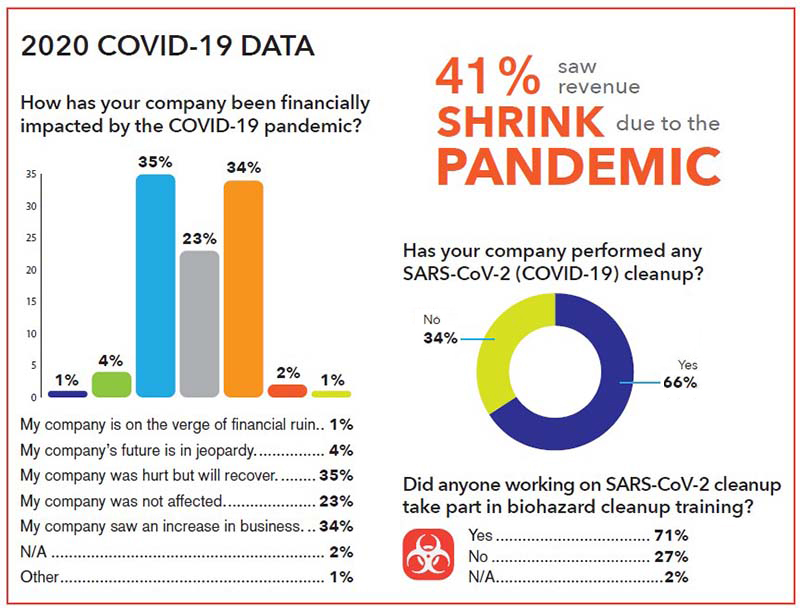

Through this year’s responses, we can see the COVID-19 pandemic still affecting companies in the industry, from revenue to most profitable service. While effects have been felt by every company, those effects are not uniform. For instance, while 41% experienced a negative financial impact due to the pandemic, another 20% saw revenue boosted by it.

It’s been another chaotic year since our last survey, but the results continue to show the strength of restorers in the face of adversity. Continue soldiering on and being a powerhouse of an industry!

About this report: The data in this survey is based on results from restoration contractors responding to invitations to participate in the survey. Results are not necessarily based on audited financial statements. Sponsored by Legend Brands, Dri-Eaz, and ProRestore Products.

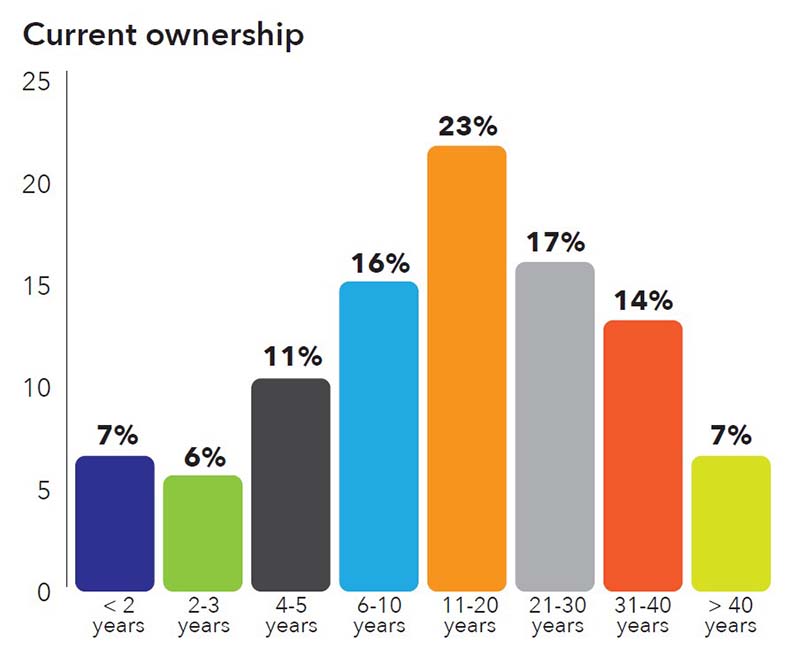

This year’s survey saw a big jump in the number of new owners in the industry. Companies with less than two years under current ownership nearly doubled. Meanwhile, the numbers fell across the board for those with more than 10 years.

Nothing has impacted the industry in the past year as much as the COVID-19 pandemic. About 40% of companies surveyed faced shrinking revenue and financial trouble from the pandemic, but 34% saw an increase in business thanks to additional COVID-19 services.

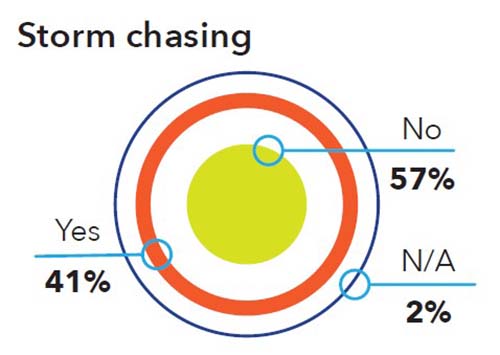

While, overall, less than half of respondents go outside their local service area for large-scale CAT work, the numbers vary by region. In Western states, only 27% say yes; whereas in the South, it’s almost half (49%), perhaps due to the frequency of tornadoes and hurricanes.

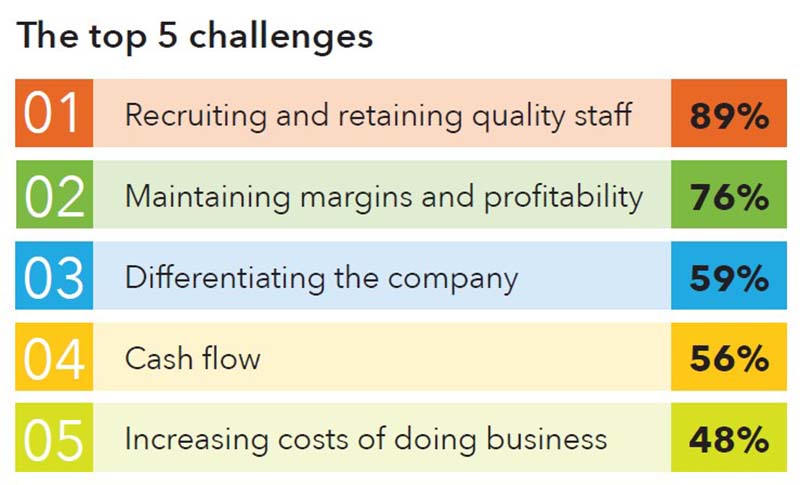

Cash flow and company differentiation swapped places, compared to the 2020 survey, reflective of the growing market saturation.

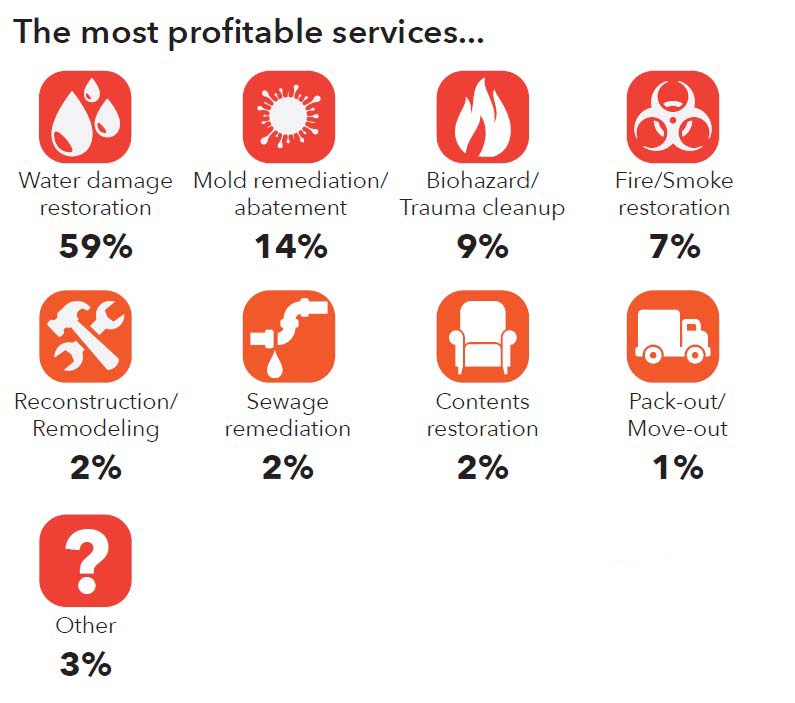

Those reporting biohazard and trauma cleanup as their most profitable service more than doubled over 2020, no doubt due to additional work in pandemic-related cleanup.

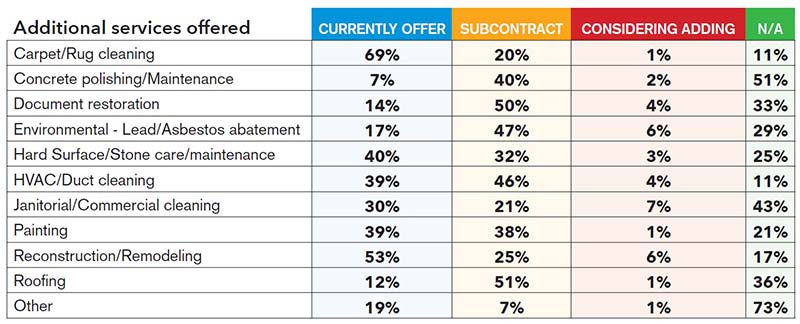

6% of companies might add reconstruction this year, which is already the second most common secondary service.

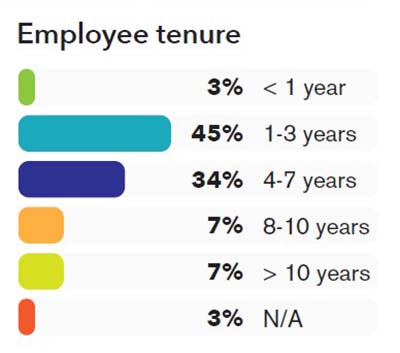

Loyalty is strong, with 51% of those with employees reporting an average tenure of more than four years.

See the 2020 Restoration Benchmarking Survey Report

Download the full report here: