2020 Restoration Benchmarking Survey Report

Welcome to another year of data and statistics directly from the restoration industry—the 2020 Cleanfax Restoration Benchmarking Survey Report, sponsored by Legend Brands. Each year we tabulate input from restorers around the United States and Canada to offer an overview of industry trends.

Much has changed in the year since our last survey, which is reflected in several survey questions. It’s been a year to remember. But despite all that has gone on in the last 12 months, the restoration industry is still strong. That is definitely clear in the responses to this year’s survey.

Much has changed in the year since our last survey, which is reflected in several survey questions. It’s been a year to remember. But despite all that has gone on in the last 12 months, the restoration industry is still strong. That is definitely clear in the responses to this year’s survey.

The hundreds of restoration companies who donated their time to take part have painted a picture of an industry that has stood strong in the face of adversity and that will generally still turn a profit despite major blows to the economy. We hope you enjoy analyzing this year’s data and seeing where your company stands among your peers.

Stay strong, restorers!

About this report: The data in this survey is based on results from restoration contractors responding to invitations to participate in the survey. Results are not necessarily based on audited financial statements.

Download the full report here.

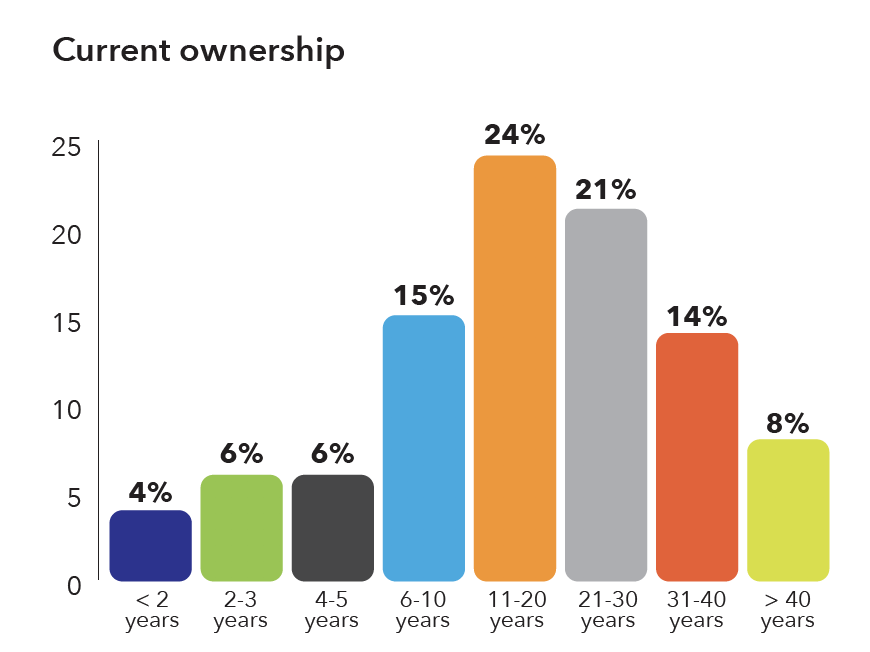

The restoration industry offers a near-balanced mix of newer and established companies, with young companies (under 10 years) making up 31%, 43% with more than 20 years, and 24% with 10-20 years in business.

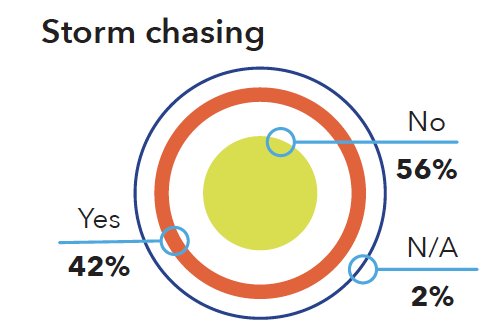

Over half of respondents find it more profitable or feasible to avoid CAT cleanup outside their areas.

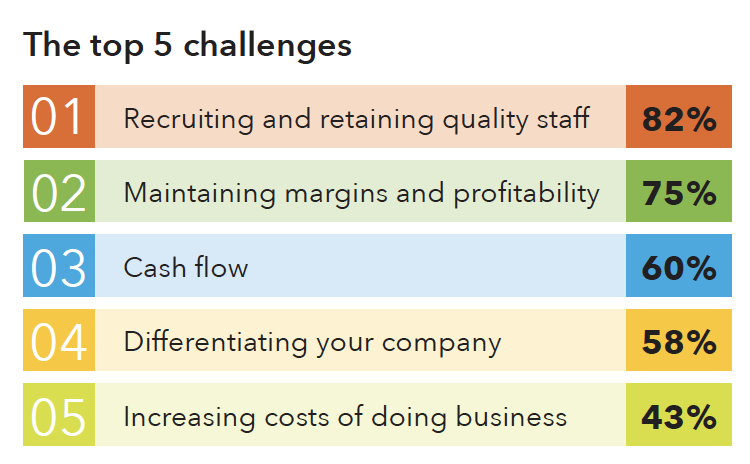

The #2 and #5 problems grew at 4% and 3%, respectively, over 2019, reflecting oft-reported pricing issues. Mean-while, the #1 and #2 problems were reported 4% less this year.

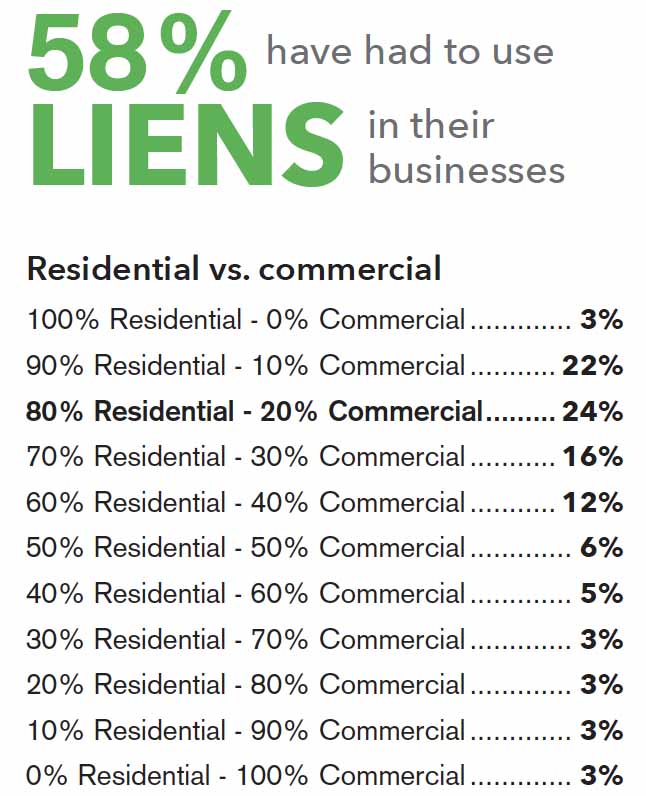

Residential work is still most common, but 2020 saw a 3% rise in those primarily doing commercial work.

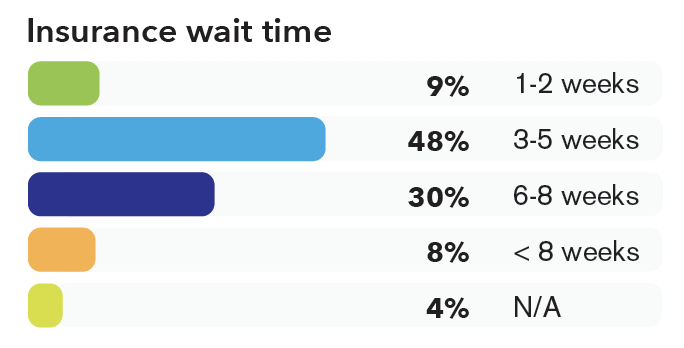

Insurance payment times seemed to improve this year, with a 5% increase in those waiting fewer than six weeks.

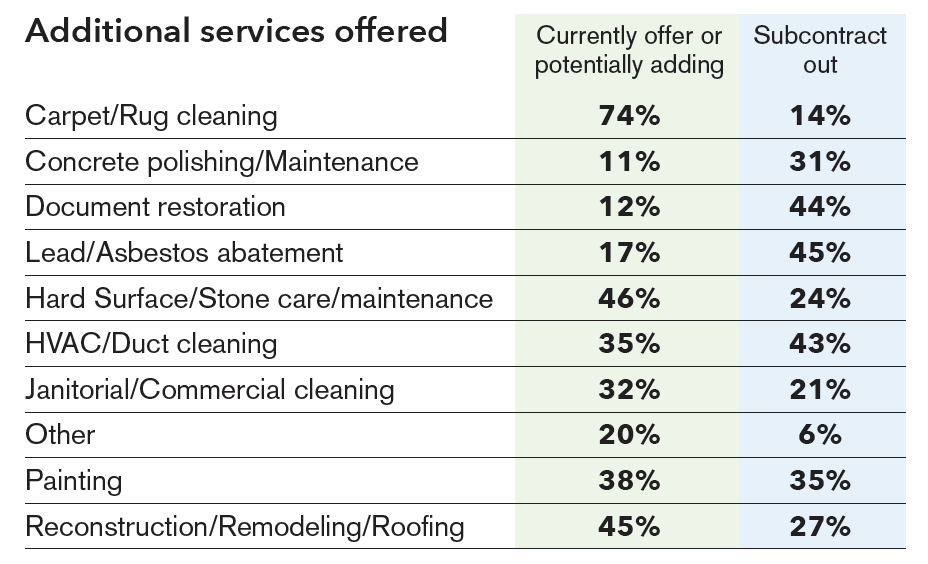

Secondary service offerings stayed relatively unchanged year over year. Hard surface care saw the biggest jump of 7 points.

2020 COVID-19 DATA

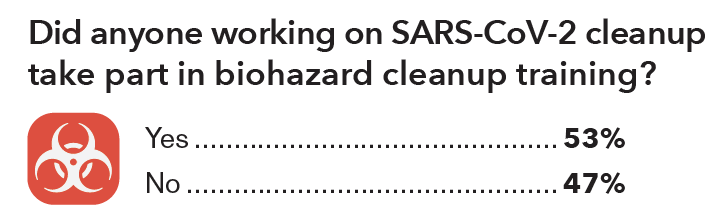

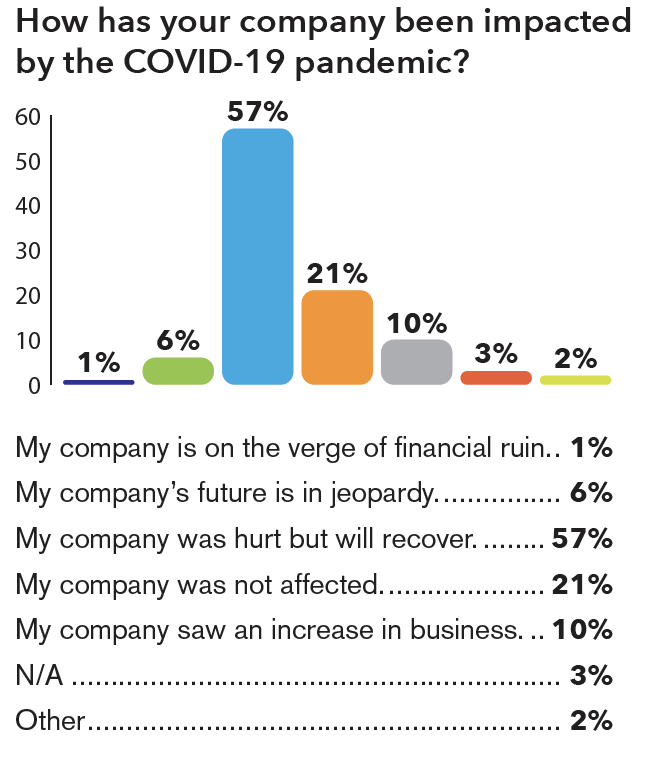

Not surprisingly, a multitude reported the COVID-19 pandemic as a chief influencer of the current state of their businesses. Half of companies have performed work in response to the virus, and 64% report their companies have been negatively affected by the outbreak, though 10% have been affected positively.

The restoration industry offers a near-balanced mix of newer and established companies, with young companies (under 10 years) making up 31%, 43% with more than 20 years, and 24% with 10-20 years in business.

Download the full results of the 2020 Restoration Benchmarking Survey Report: