The 2022 Restoration Benchmarking Survey Report

It’s time to crunch the numbers, analyze the data, and see how your disaster restoration company compares to your peers in the industry. The annual Cleanfax Restoration Industry Benchmarking Survey Report polls the leaders in the industry to capture a complete snapshot of operations, revenue, services offered, challenges faced, employee issues, and more.

As you read on, you will see information that helps you form a better, more complete understanding of the state of the disaster restoration industry.

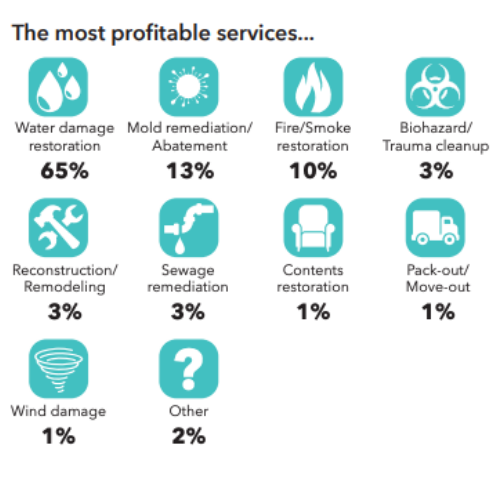

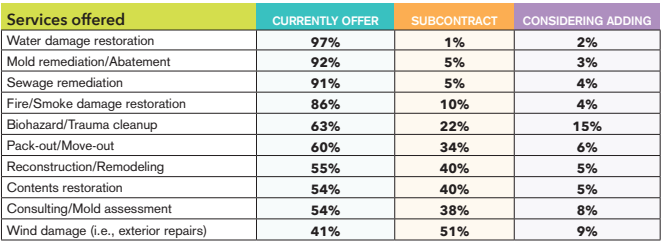

Of interest in the survey is how the vast majority of you, 97% to be exact, offer water damage restoration, closely followed by mold remediation/abatement (92%), and sewage remediation (91%). Less than 5% of companies responding to the survey subcontract out any of that. When service offerings move into fire/smoke, biohazard, and others on the list, subcontracting becomes more common.

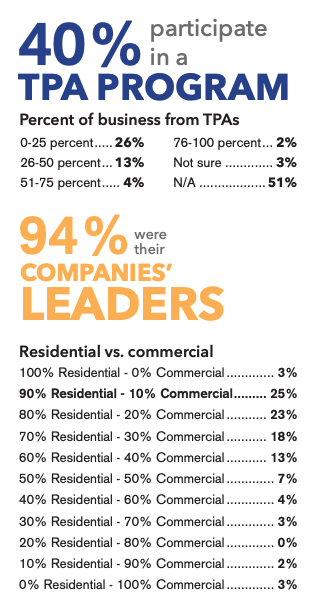

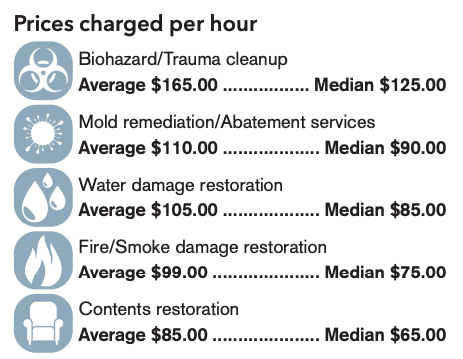

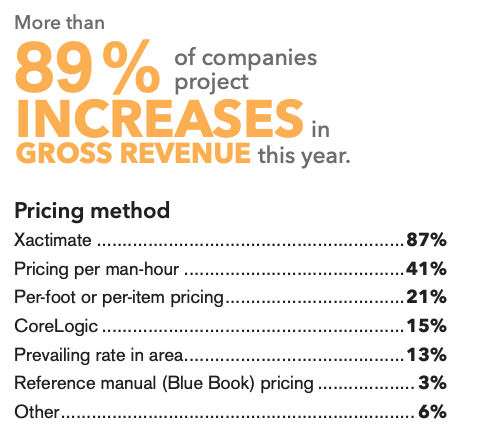

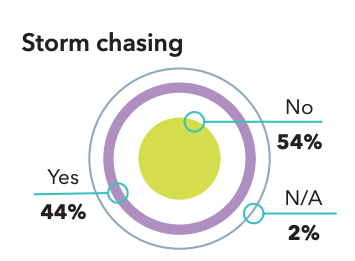

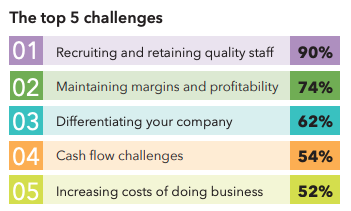

Those involved in TPA programs dropped 4% from last year, with more engaged in storm chasing projects, the highest number traveling outside their area for CAT work since 2014. And, of course, everyone said that staffing issues were important. Recruiting and retaining quality workers remains at the very top of the challenges facing companies. For pricing, the highest per-hour charge on average goes to biohazard/trauma cleanup, followed by mold remediation and then water damage restoration. You can see the data in the survey and compare your own charging practices to the industry. Cleanfax thanks all those who participated in the survey and helped create this valuable industry resource. Now, dig in and check out all the data, and use the link below to download the full report.

About this report: The data in this survey is based on results from restoration contractors responding to invitations to participate in the survey. Results are not necessarily based on audited financial statements. Sponsored by Legend Brands.

Click here to download the entire survey report in PDF format

See below for snapshots of the data:

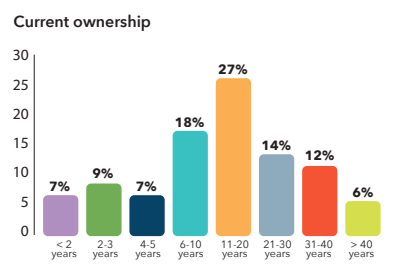

This year, the majority (59%) of companies reported owner tenures of more than 10 years. Nearly a third have had the same owner for more than 20 years.

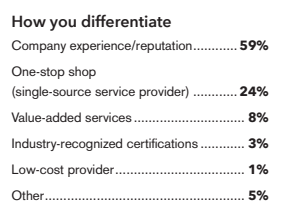

Competing is all about how you stand out from the competition. Experience and reputation is what drives most restoration companies.

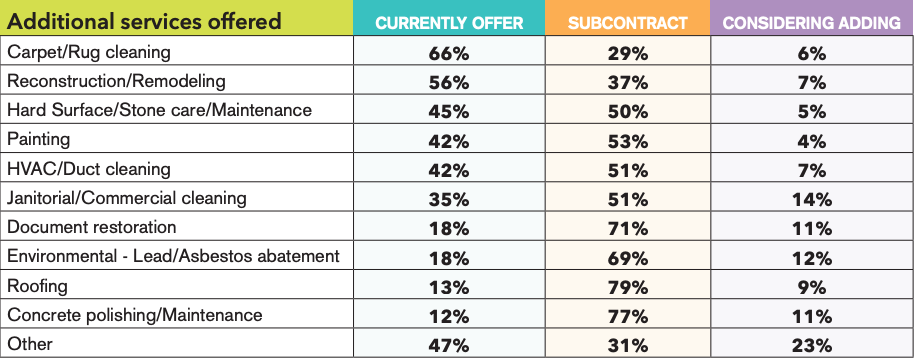

The majority of companies offer water damage restoration services yet remain firmly diverse with other service offerings, which means one-stop shopping for customers and adjusters is possible. Rarely do companies outsource basic services.

This year saw the highest number of respondents traveling outside their area for CAT work since 2014.

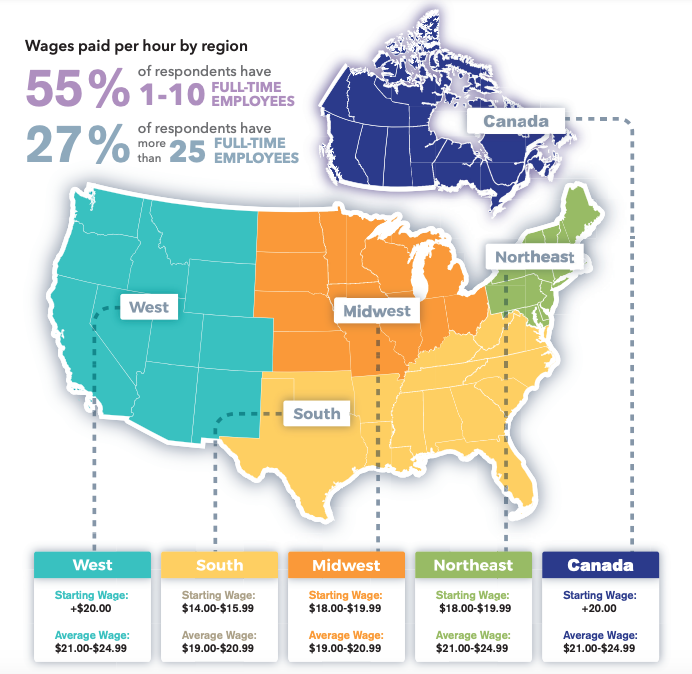

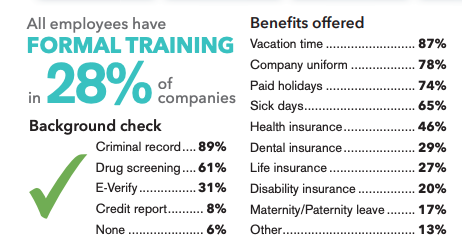

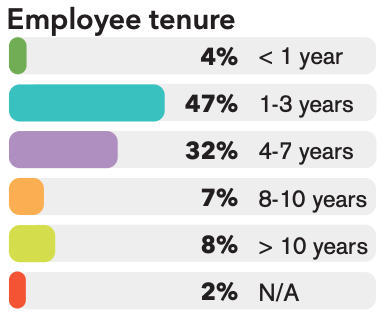

Not a single respondent said staffing issues were unimportant, which is unsurprising given the current labor market.

Offered additional services rose across the board with the exception of carpet cleaning, which dropped 3% from last year.

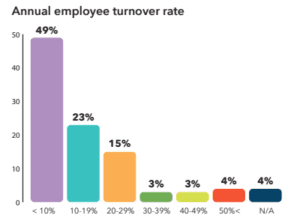

Challenges keeping employees are clear, with more than half reporting average employee tenures of less than three years.