Know Your Rights With Property Insurance Claims

Navigating property insurance claims can be challenging, particularly without a solid grasp of the rules and procedures that guide the process. Contractors must have a thorough understanding of the entire property insurance claim lifecycle to navigate it effectively and manage claims, ensuring smoother resolutions.

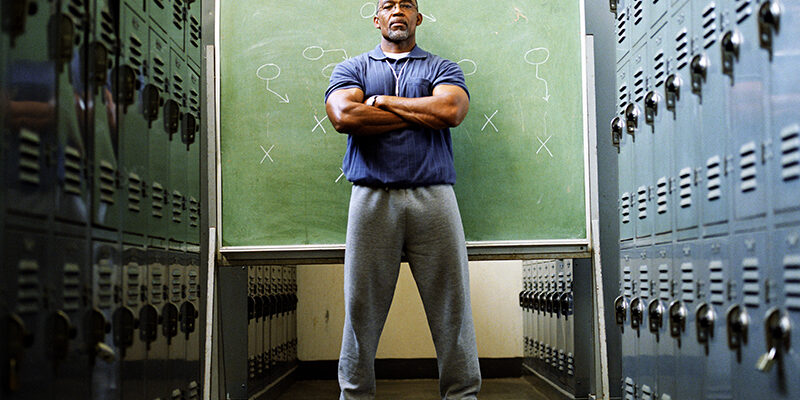

“Let’s talk about what really happens,” said Darrick O’Day, lead public insurance adjuster and founder of Pine Hills Property Claims. He brings over two decades of construction experience to the table, and his approach is rooted in hands-on knowledge. He knows that insurance claims are rarely as straightforward as they look on paper.

A ‘simple’ claim

A simple claim should go like this: a loss happens, the property owner files a claim, and the insurance company inspects the damage and makes a fair decision. If approved, payment follows, and the work gets done. But is that just a fantasy?

O’Day said, “That’s all based on good faith and fair dealing. What actually happens? Usually a wrongful denial.”

O’Day is quick to acknowledge that not every denial is malicious. Discrepancies happen. But once a denial is issued, the policyholder has a choice: Walk away—or stand on the policy.

Standing on the policy: your duties after loss

Before an insurance company is obligated to do anything, the policyholder must fulfill what’s known as their “duties after loss.” O’Day emphasized how critical this step is—and how often it’s misunderstood.

“Most people think the insurer has an obligation to jump in and fully investigate and pay out,” he said. “But most policies are retroactive. You—the insured—have to act first.”

That means protecting the property from further damage, documenting repairs and expenses, cooperating with investigations, and preparing an inventory of loss. “They’ll want documents,” O’Day said. “They’ll want records. They might want an examination under oath. And yes, sometimes what they ask for feels unreasonable.”

Still, he advised clients and contractors to comply, document objections, and continue moving forward. “Ultimately, it’s not your call to decide whether their process is fair. Let someone else—like an attorney or public adjuster—make that case later.”

Get the certified policy—and read it all

O’Day stressed that one of the most critical tools in this process is the certified copy of the insurance policy. This is not the one agents email clients or a brochure, but a certified copy. “It’s longer,” O’Day said. “It’s denser. But it’s the only version that matters.”

Why? Because every clause in the policy can alter another. “Insurance policies are like legal riddles,” he explained. “I highlight them in five colors. Green means you have coverage. Pink means it’s gone. Blue? Maybe it’s back.”

Even then, he noted, a certified copy is only as complete as the insurer allows. “I’ve had companies certify policies that are still missing pages,” he said. “But at least you’re on record relying on what they gave you.”

Valuing the loss

Once a policyholder has their certified copy, the next move is preparing an itemized valuation of the damage. This is where contractors often get involved—but there’s a limit.

“You can research local code,” O’Day explained. “You can estimate costs. But you can’t interpret coverage or apply policy exclusions. Only public adjusters or attorneys can do that on someone else’s behalf.”

That itemized valuation feeds into the “proof of loss,” a formal demand under the policy. Some states require insurers to respond within 30 days. Others? “There’s no teeth,” he said. “But even then, filing it is critical. Until you do, your insurer has no duty to pay. The clock doesn’t even start.”

Release the undisputed money

One of O’Day’s favorite tactics is to remind insurers that if they’ve agreed to a certain value, they must pay it—regardless of what’s still in dispute.

“If you say, ‘it’s $138,000,’ and I say, ‘it’s $300,000’—great,” O’Day said. “You still owe me the $138K. Pay it. That part’s not in question.”

That same logic applies to checks that come before restoration contractors get involved. “Unless the check has a legal release written on it, cash it,” he advised. “Holding it doesn’t give you more leverage. It just lets them hold onto your money longer.”

When to push further

When insurers partially or fully deny a claim, the key is understanding what kind of denial you’re dealing with. “A partial denial means they’re acknowledging some damage,” O’Day said. “A full denial means they say nothing happened at all.”

That difference shapes your path forward. From there, policyholders can push for revisions, file complaints with the state, or trigger dispute resolution clauses like appraisal, arbitration, or litigation.

“And yes, once you’re in those lanes, things slow down,” he admitted. “Claims move at their own pace. Sometimes it’s fast. Sometimes, it’s like molasses. But you must follow the process.”

The roles of contractors and policy adjusters

O’Day was clear on the limits of contractor involvement. “You’re not allowed to negotiate a claim on someone else’s behalf unless you’re licensed to do so,” he said. “But you can advocate for your own invoices and question decisions.”

He encouraged contractors to ask tough questions when adjusters try to dispute line items: “Where are you calling from? Did you inspect the job? What are your qualifications? No? Okay, well then, we’ll proceed accordingly.”

He also stressed the importance of separating mitigation from rebuild in your documentation—especially when policy caps are in play. “Label things clearly,” he said. “Make it easy for someone reviewing the file to say, ‘This was an emergency. This is covered separately.’”

AI and the future of claims interpretation

When asked about using AI tools to interpret policies, O’Day didn’t shy away. “ChatGPT is a sword,” he said. “In the hands of a master, it’s powerful. In the hands of a novice? Dangerous.”

He encouraged the use of AI for insight—but warned against treating its output as legal or binding. “Use custom prompts,” he explained “Understand the definitions. Remember, some words are defined in statute, some in case law, and some in the policy itself.”

‘Good faith’ over ‘bad faith’

O’Day avoids accusatory language. “I never say ‘bad faith,’” he explained. “That’s for the courts. But I do ask, ‘How in good faith could you possibly decide this?’”

It’s a strategic move. Calling something bad faith too soon can change how an insurer handles the file. “They’ll redact documents, shut down communication, and gear up for litigation,” he explained. “That’s not always what you want.”

Do the work, know the game

O’Day offered five clear takeaways:

- Demand the certified policy.

- Read it in full.

- Fulfill your duties after loss.

- Submit formal proof of loss.

- Understand what your contractor role does—and doesn’t—entitle you to do.

“This stuff’s complicated,” he said. “But it’s not impossible. Know your lane, know your rights, and do the job right from the start.”